Congress authorized spending $2.2 trillion as part of the CARE Act in early April 2020 and an additional $0.5 trillion a couple of weeks later. The Federal Reserve also authorized monetary easing that is estimated to be around $2.2 trillion of guaranteed loans. All of these stimulus packages taken together means the US government is pumping more than $4.9 trillion into the economy in order to ease the economic impact of the Covid 19 pandemic. A very small percentage of this amount makes it the businesses and people who really need it, and the majority is going to businesses that do not need it. Tax payers have become the losers in this gambit where they collectively have an additional $4.9 trillion plus interest to pay back.

Congress authorized spending $2.2 trillion as part of the CARE Act in early April 2020 and an additional $0.5 trillion a couple of weeks later. The Federal Reserve also authorized monetary easing that is estimated to be around $2.2 trillion of guaranteed loans. All of these stimulus packages taken together means the US government is pumping more than $4.9 trillion into the economy in order to ease the economic impact of the Covid 19 pandemic. A very small percentage of this amount makes it the businesses and people who really need it, and the majority is going to businesses that do not need it. Tax payers have become the losers in this gambit where they collectively have an additional $4.9 trillion plus interest to pay back.

Another way of thinking about this expenditure is to imagine the government reaching into the pockets of every one of the 143 million taxpayers and taking $34,265 from each. Consider for a minute if every taxpayer had a guaranteed line of credit or the cash equivalent of $34,265! How much more do you think a sum this large would help individuals survive or even thrive through this unfortunate Covid-19 pandemic?

If the goal was to help individuals and small businesses, wouldn’t the $34,265 in the hands of taxpayers do wonders in helping them pay rent, keep food on the table, and sustain small business income until the pandemic has passed? Instead, this money is landing in the coffers of entities that would survive without it but have the right connections and expertise to get to it-- with only a fraction of the total reaching individuals and small businesses, who supposedly are the justification for these expenditures in the first place. So, which amount do you think will do the most good for the average taxpayer, $1,200 or $34,265?

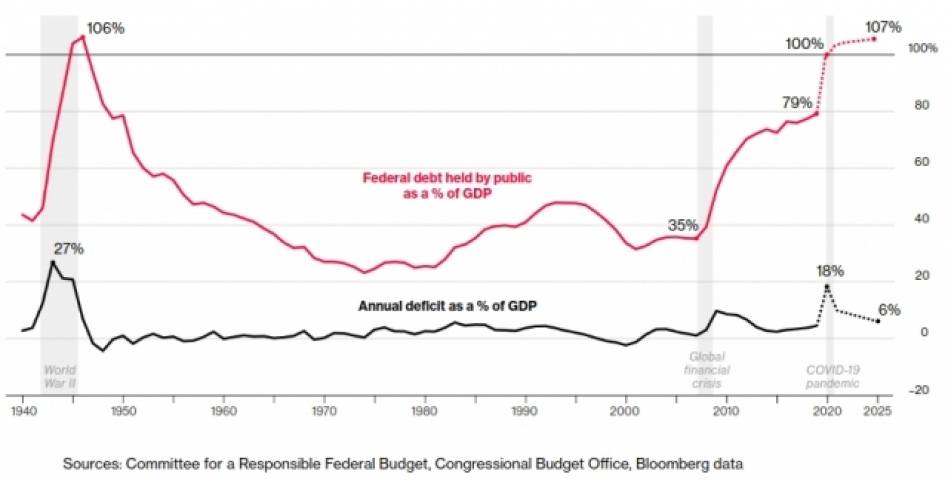

Let’s look at another result of what these expenditures will mean to the mountain of debt we have already accumulated before Covid-19. As the graph shows, this will be the first time since the end of WWII where the federal debt level will exceed 100% of GDP.

These unlimited, and basically unchecked, government expenditures in the name of “stabilizing the economy” during this crisis should be addressed. Each and every one of us should ask ourselves, “What is the long-term effect of these expenditures and expanding indebtedness on current and future US economic stability? ” If we don’t keep watch on what is happening to our tax dollars, the government will have our blessings to just keep on spending. It affects all us from investors, owners, and CEOs to borrowers, renters and laborers! Are our future opportunities being thrown away in one lump sum?